2,019 reads

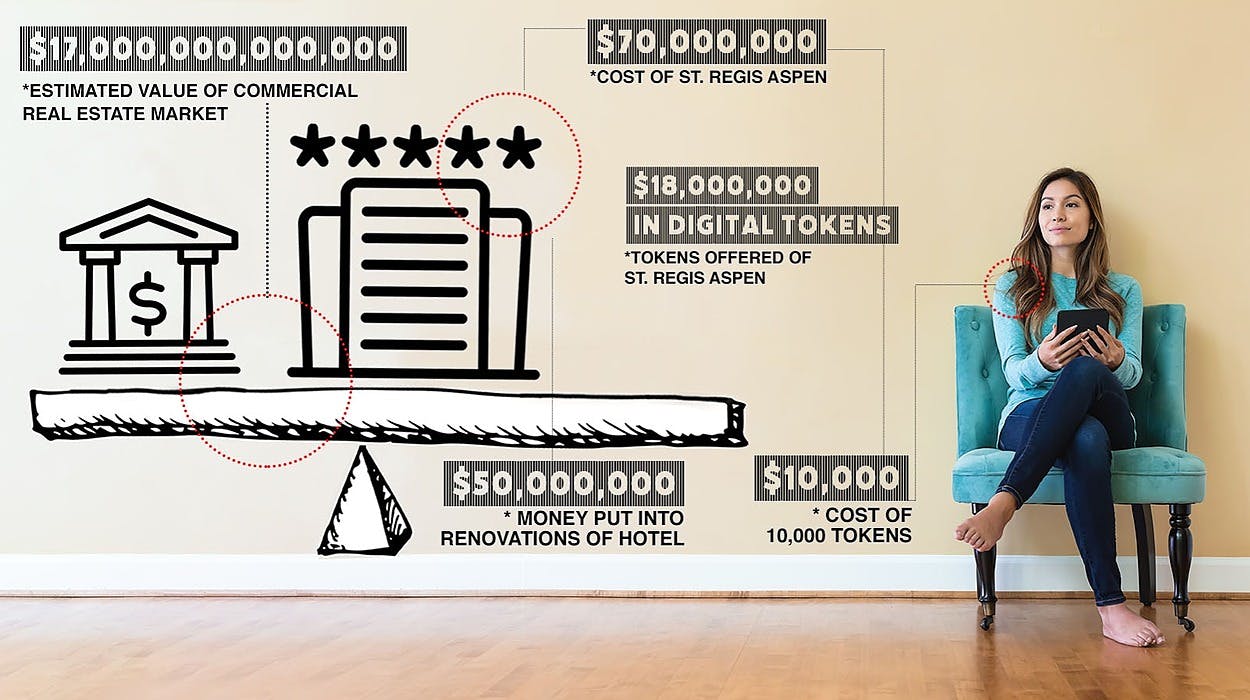

Tokenized Real Estate: A $17 Trillion Opportunity

by

November 21st, 2019

ELEV8’s vision is that new emerging technologies such as AI, blockchain, cryptocurrencies, and digit

About Author

ELEV8’s vision is that new emerging technologies such as AI, blockchain, cryptocurrencies, and digit