1,786 reads

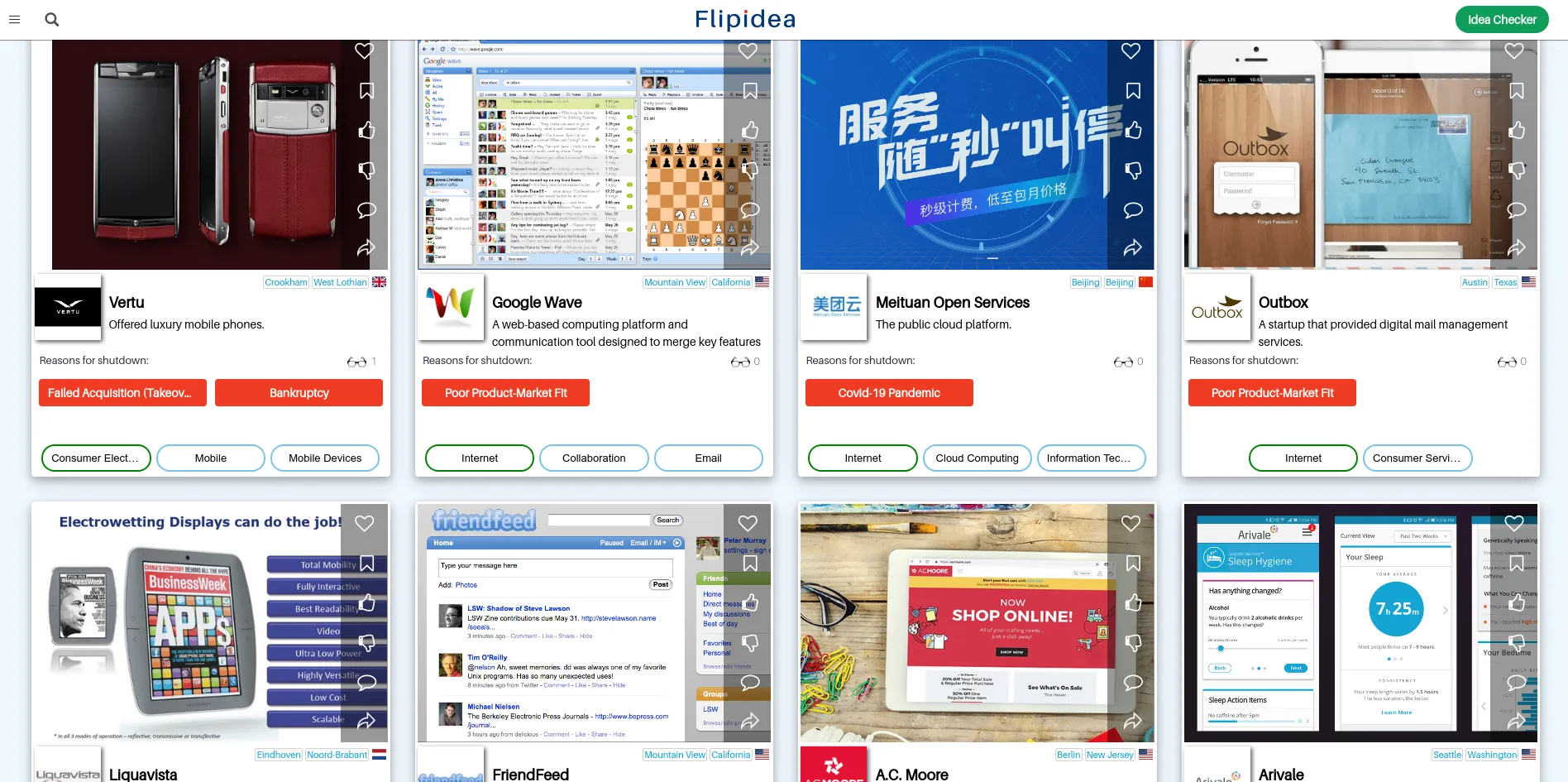

Descriptive Analysis: Why Did These 500 Trending Startups Shut Down?

by

June 24th, 2020

affordable startup intelligence for founders building high-ROI and strong competitive business

About Author

affordable startup intelligence for founders building high-ROI and strong competitive business