6,087 reads

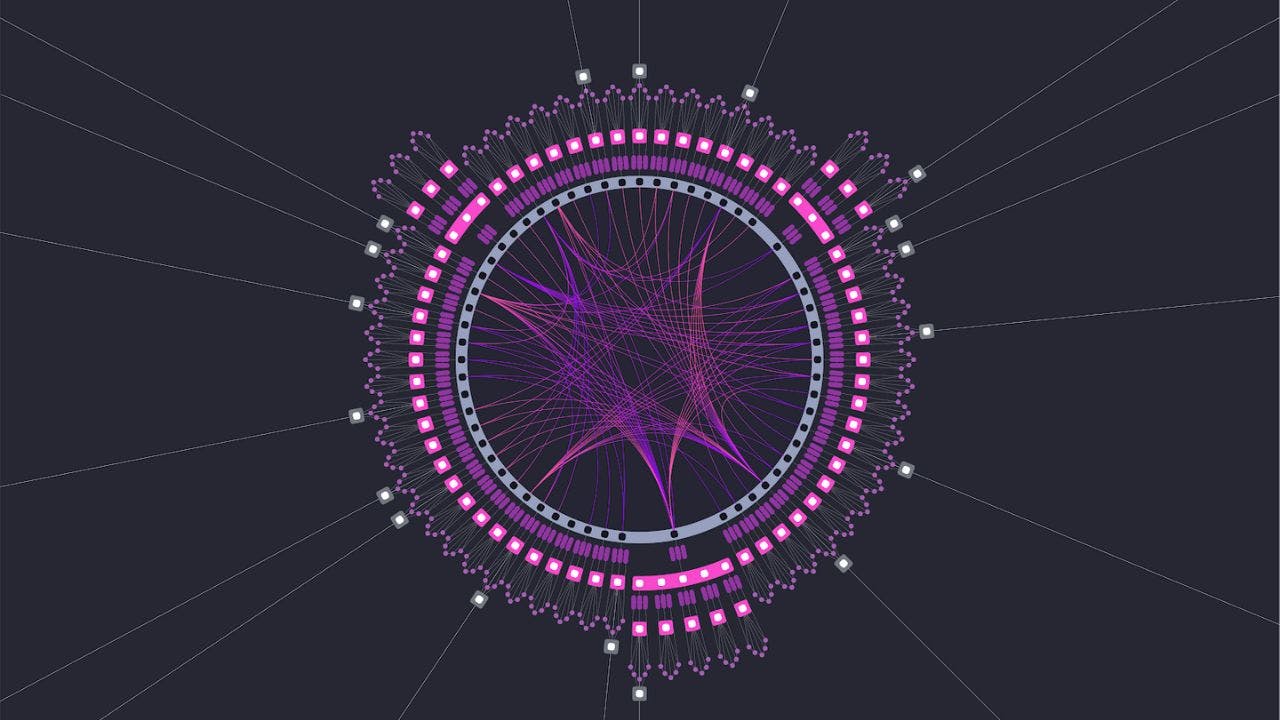

5 Polkadot Parachains to Look Out for in 2022

by

May 17th, 2022

Audio Presented by

I share insights about the latest developments in startups, blockchain technology, apps and artificial intelligence.

About Author

I share insights about the latest developments in startups, blockchain technology, apps and artificial intelligence.