599 reads

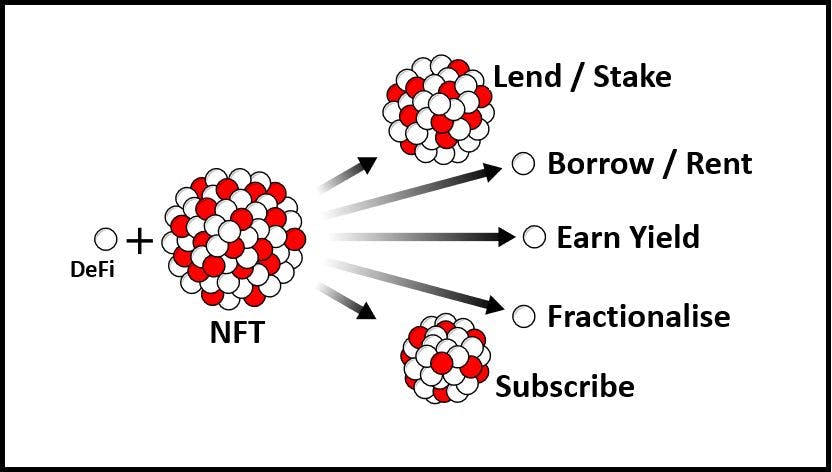

Unlocking Value Stored in NFTs – An Introduction to NFT Finance

by

January 5th, 2022

Audio Presented by

Runs Regular.li, TheCryptoUncle | Mods Parachute, Hedgey, ParJar | Advises NamastePunks

About Author

Runs Regular.li, TheCryptoUncle | Mods Parachute, Hedgey, ParJar | Advises NamastePunks

Comments

TOPICS

Related Stories

µRaiden: Micropayments for Ethereum

HackerNoon Writer

Sep 19, 2017

µRaiden: Micropayments for Ethereum

HackerNoon Writer

Sep 19, 2017