3,691 reads

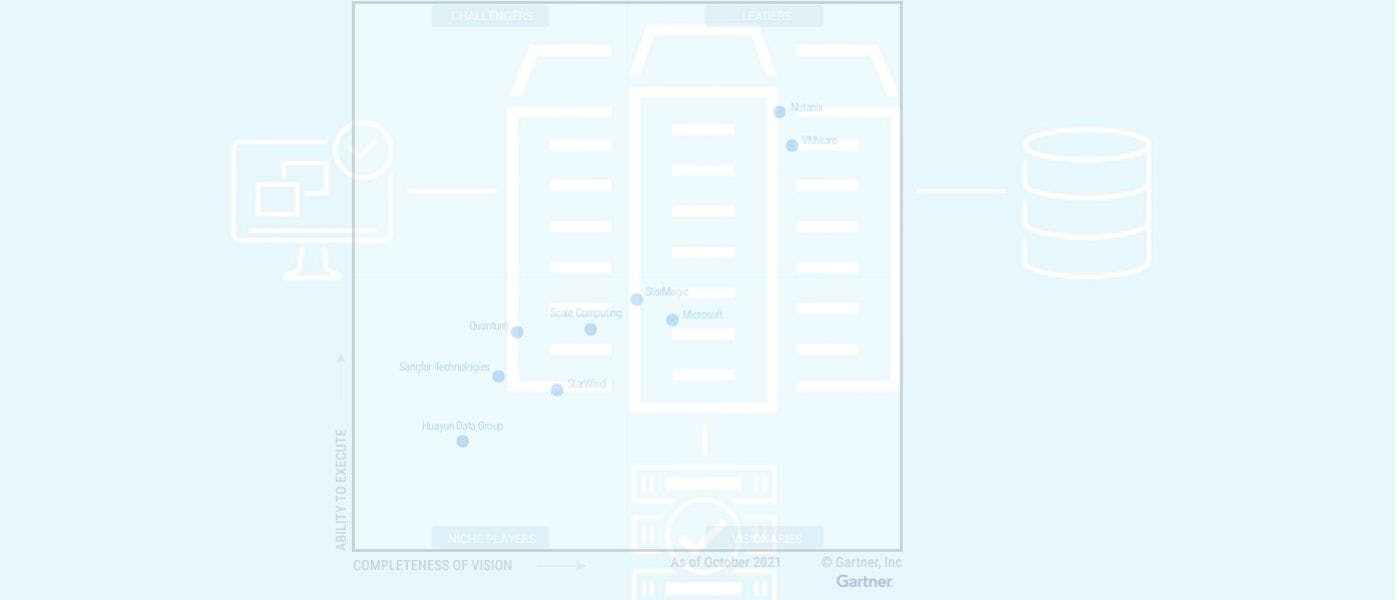

Top Players in the Hyperconverged Infrastructure Software Market for 2022

by

September 21st, 2022

Audio Presented by

Priya: 10 yrs. of exp. in research & content creation, spirituality & data enthusiast, diligent business problem-solver.

About Author

Priya: 10 yrs. of exp. in research & content creation, spirituality & data enthusiast, diligent business problem-solver.