2,425 reads

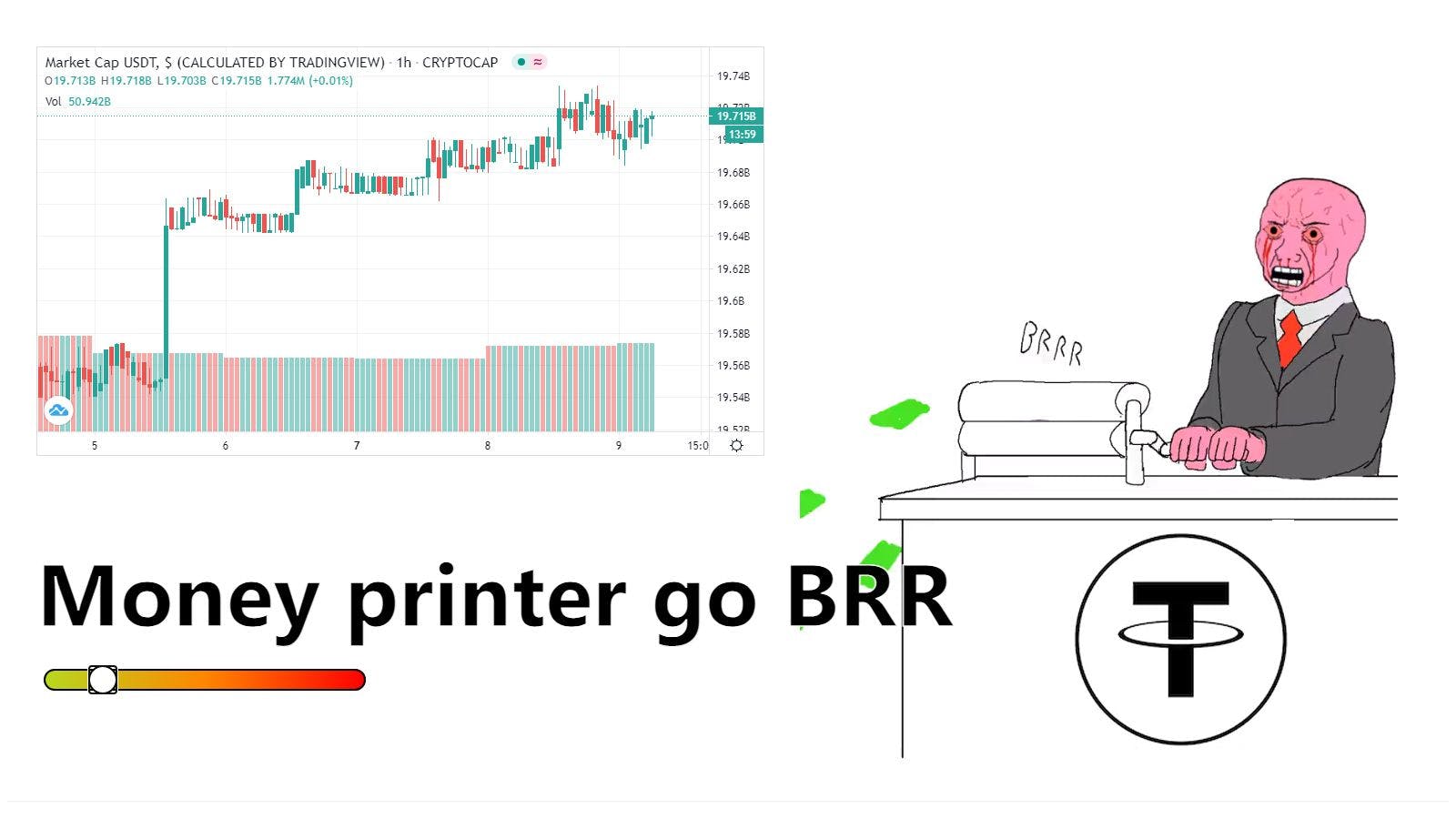

Tether Is No More A Cryptocurrency Than Every Other FIAT Money Out There

by

December 11th, 2020

Audio Presented by

Turning onchain madness into readable magic. Crypto journalist. DeFi, Web3, SEO — served longform, not lukewarm.

About Author

Turning onchain madness into readable magic. Crypto journalist. DeFi, Web3, SEO — served longform, not lukewarm.