478 reads

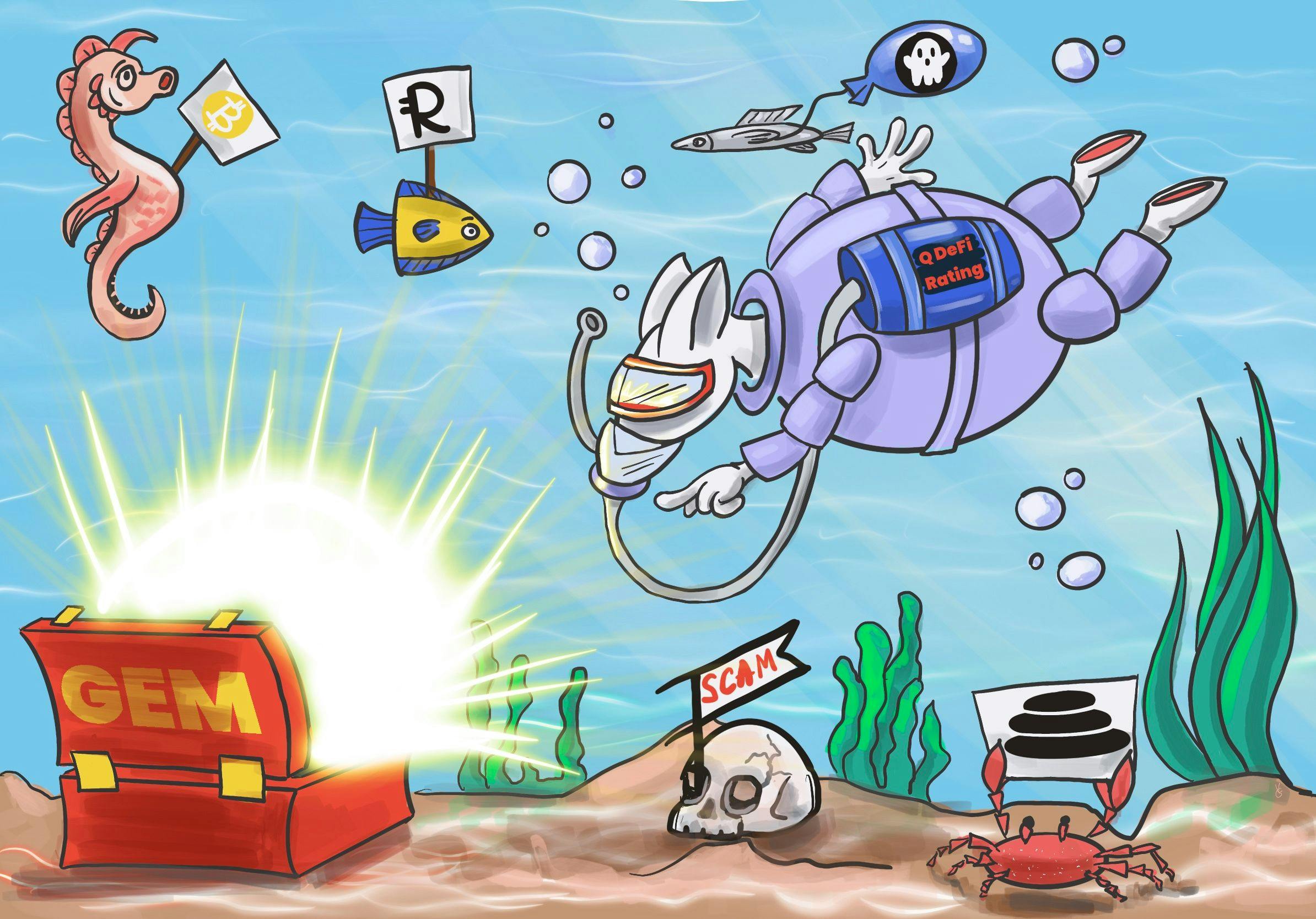

Make The Most Out of Your Portfolio With A Q DeFi Rating

by

April 20th, 2021

CEO and co-founder of Platinum Software Development Company. Blockchain enthusiast, blogger.

About Author

CEO and co-founder of Platinum Software Development Company. Blockchain enthusiast, blogger.