1,397 reads

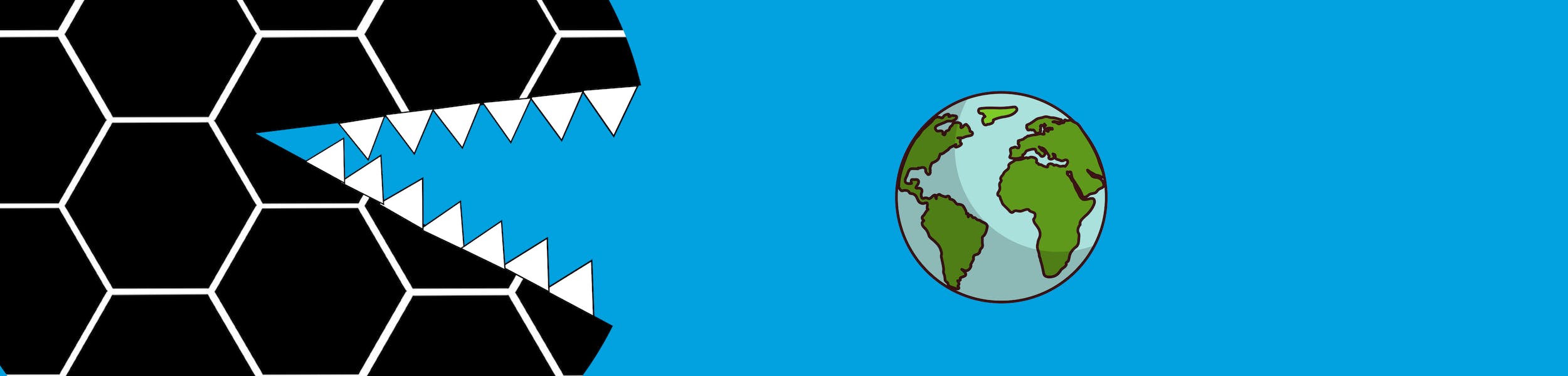

How blockchain is eating the world

by

February 12th, 2019

Technical marketer with startup experience; co-founder of blockchain platform Provide Technologies.

About Author

Technical marketer with startup experience; co-founder of blockchain platform Provide Technologies.