1,252 reads

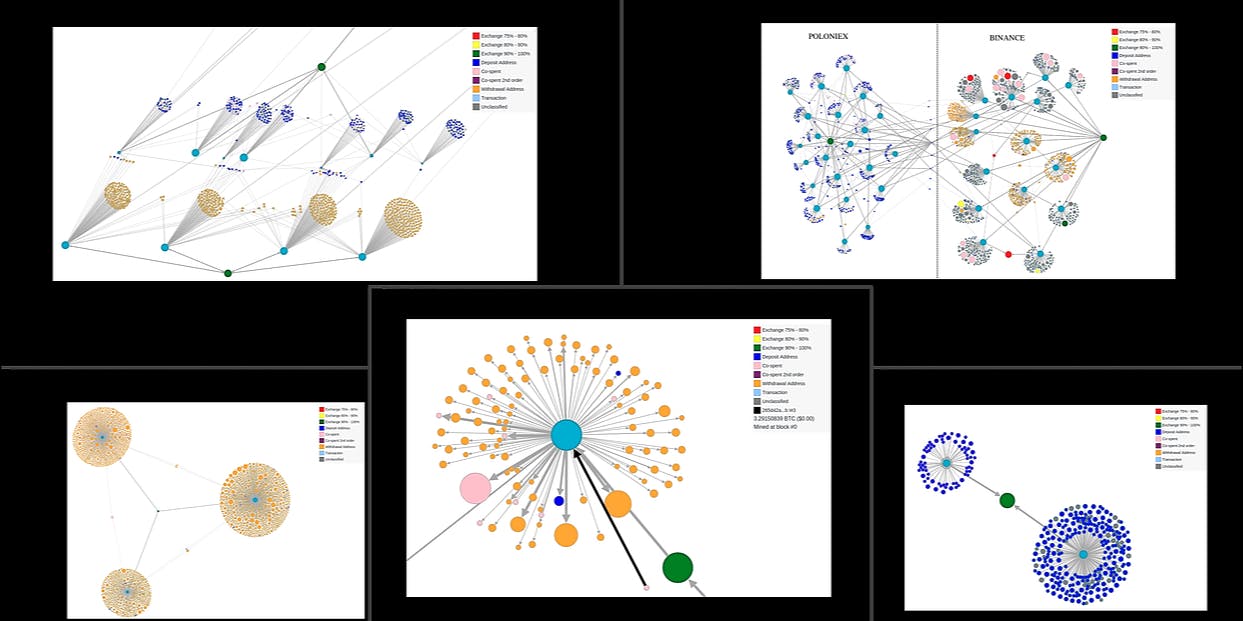

Centralized Crypto Exchanges Explained in 5 Fascinating Data Visualizations

by

September 5th, 2019

Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa

About Author

Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa