1,222 reads

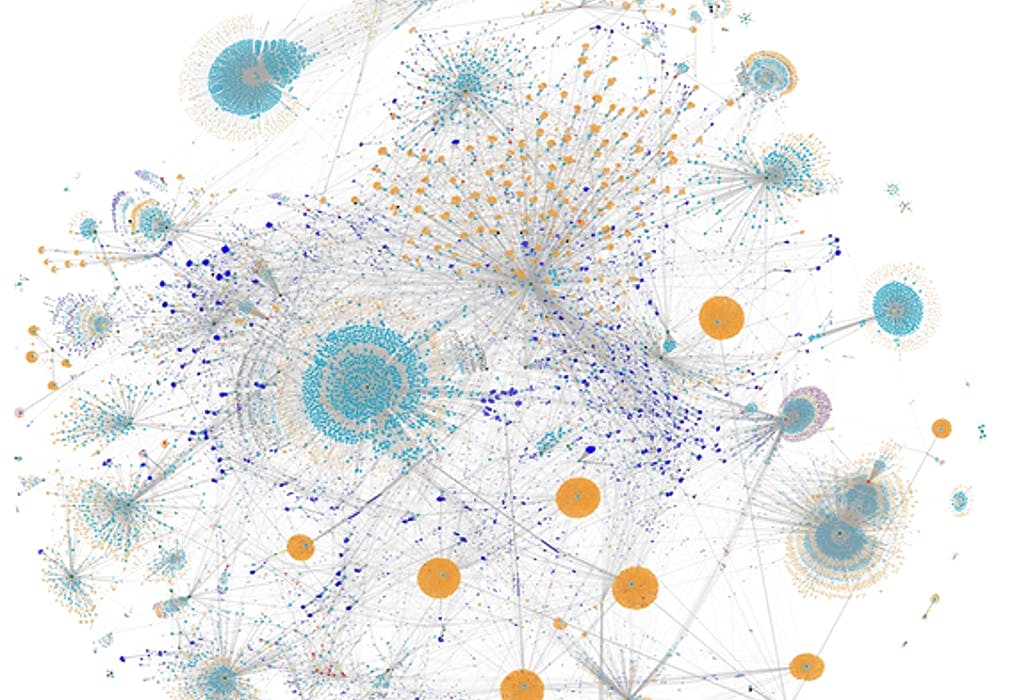

10 Patterns of Centralized Crypto Exchanges Explained Using Machine Learning and Data Visualizations

by

October 8th, 2019

Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa

About Author

Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa