857 reads

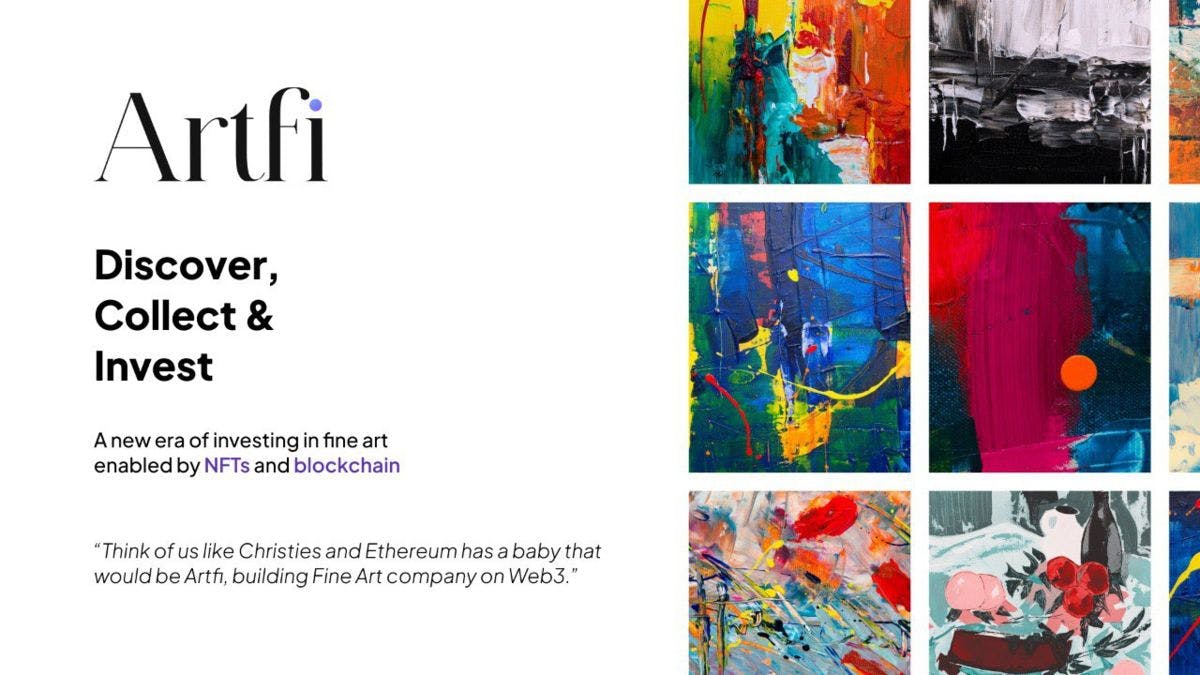

A Look at Artfi: The Fine Art Investing Platform

by

November 7th, 2022

Audio Presented by

Technology enthusiast with a focus on AI, startups and blockchain, bringing the latest news and insights to readers.

About Author

Technology enthusiast with a focus on AI, startups and blockchain, bringing the latest news and insights to readers.