299 reads

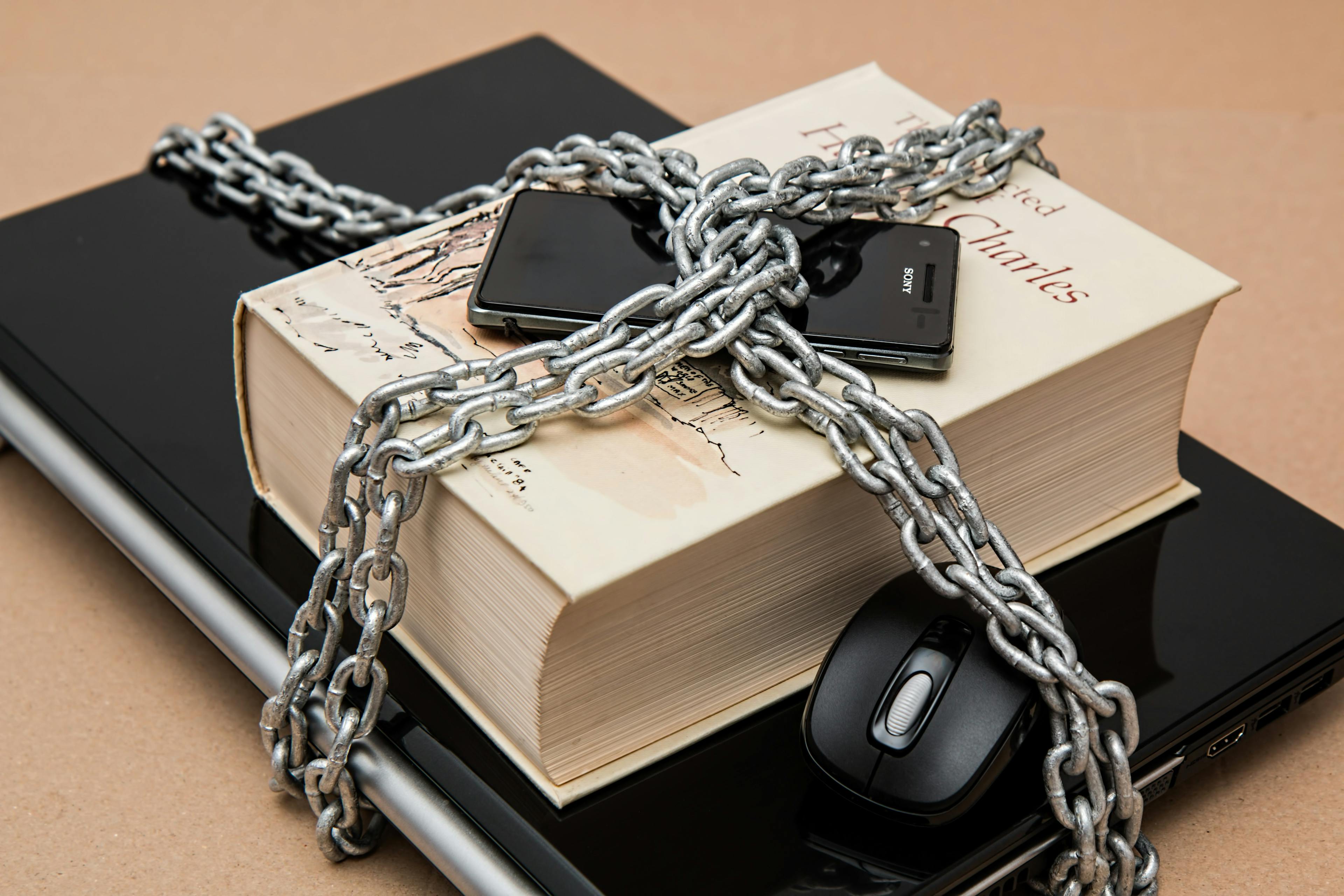

4 Protections that Every Startup Needs

by

December 10th, 2019

Writer, PR Expert, SEO Specialist: Contributor @ Info-Sec Magazine, Forbes, Adweek, MarketWatch, Etc

About Author

Writer, PR Expert, SEO Specialist: Contributor @ Info-Sec Magazine, Forbes, Adweek, MarketWatch, Etc