21,248 reads

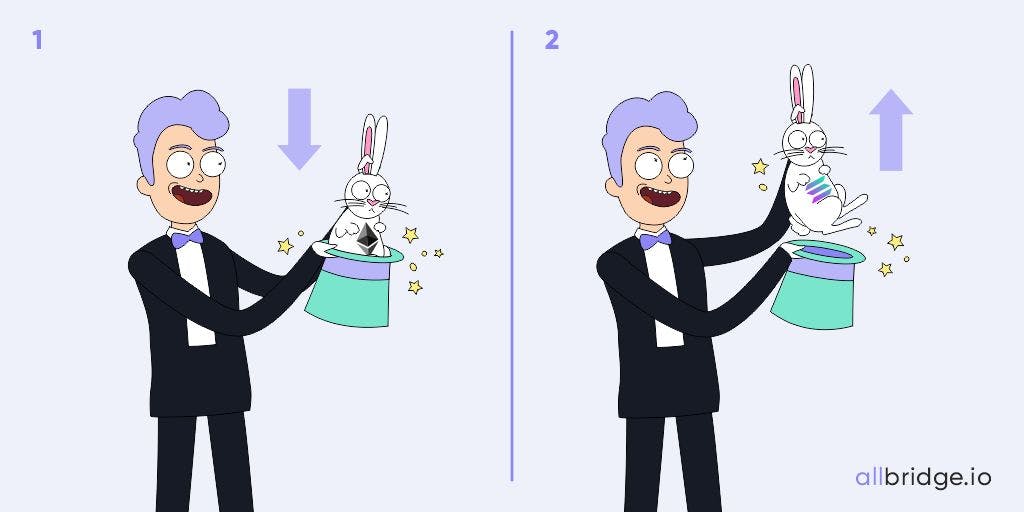

Transferring Tokens Across Blockchains: The Definitive Guide to Bridges, Atomic Swaps, and More

by

September 5th, 2021

Audio Presented by

I write about Product Management, Marketing, and New Technologies

About Author

I write about Product Management, Marketing, and New Technologies