1,002 reads

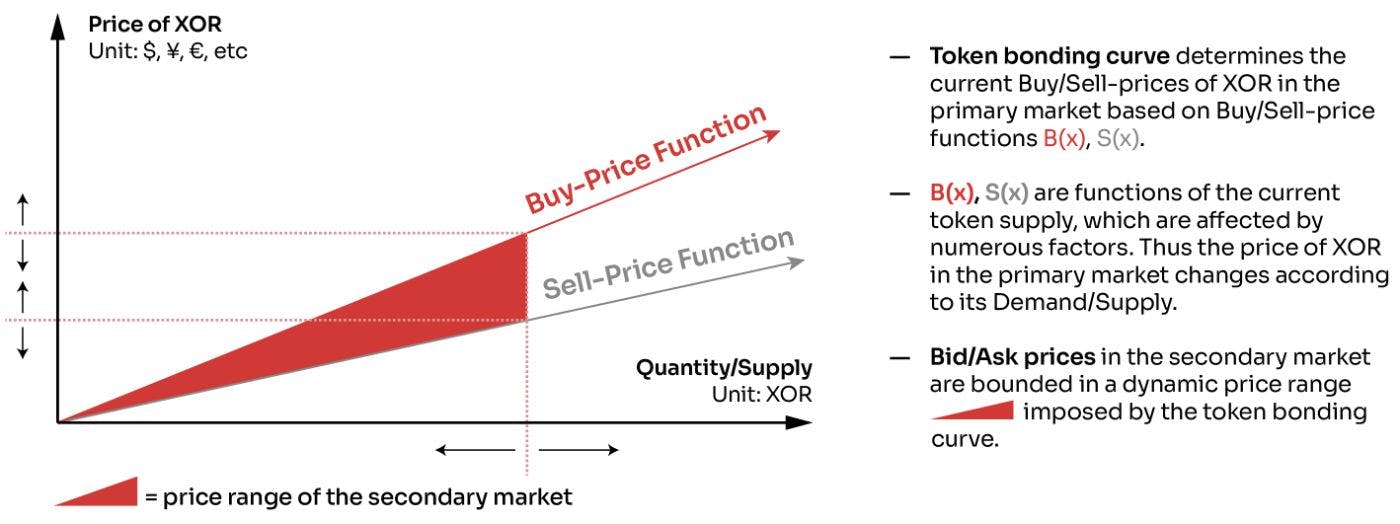

The Simple Rationality of Token Bonding Curves

by

August 4th, 2022

Audio Presented by

Fighting for a decentralized supranational world economic system. -SORA-

About Author

Fighting for a decentralized supranational world economic system. -SORA-