152 reads

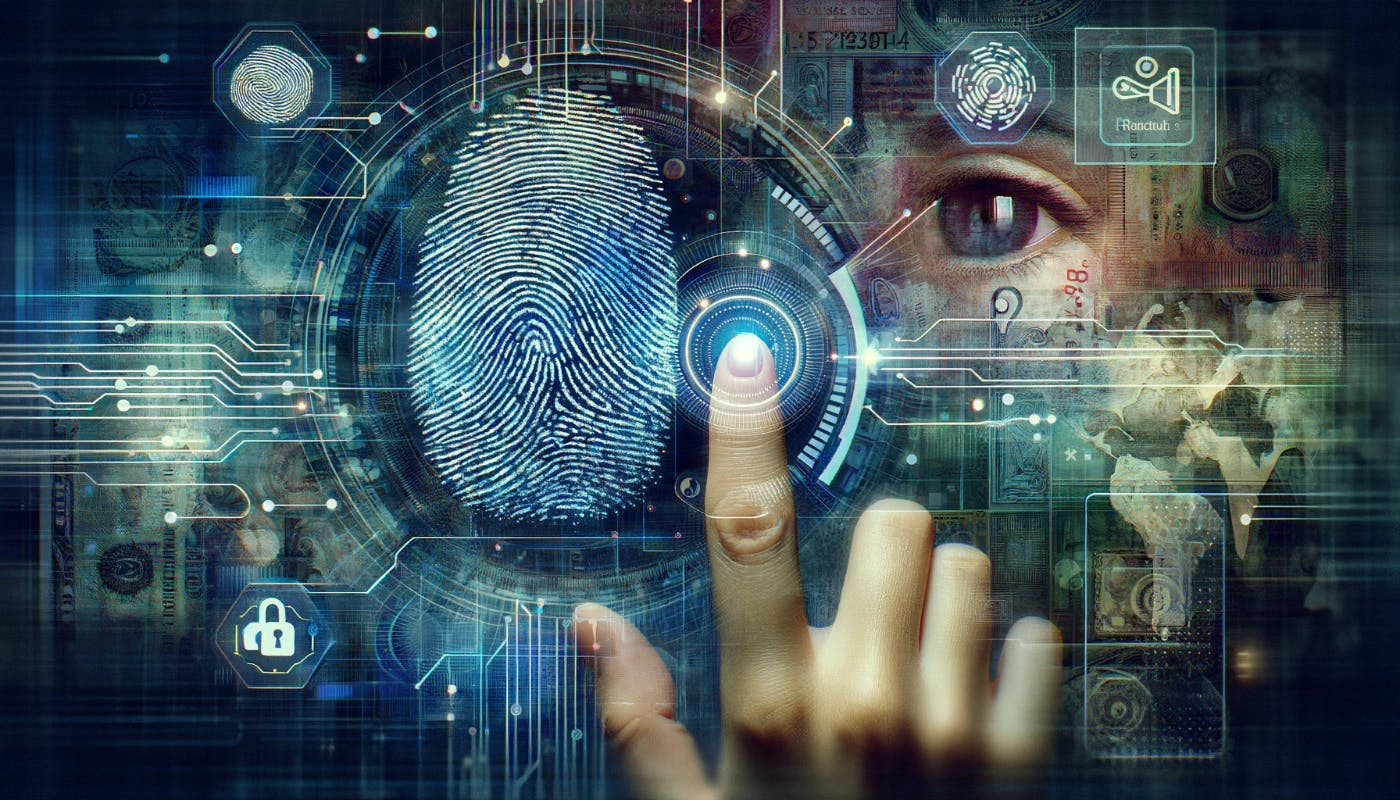

The Future of Financial Inclusion: Is Biometric Cardless Payment the Answer?

by

December 7th, 2023

Audio Presented by

Nitesh is associated with Concurate where he helps B2B SaaS businesses reach outstanding growth with content marketing.

About Author

Nitesh is associated with Concurate where he helps B2B SaaS businesses reach outstanding growth with content marketing.