239 reads

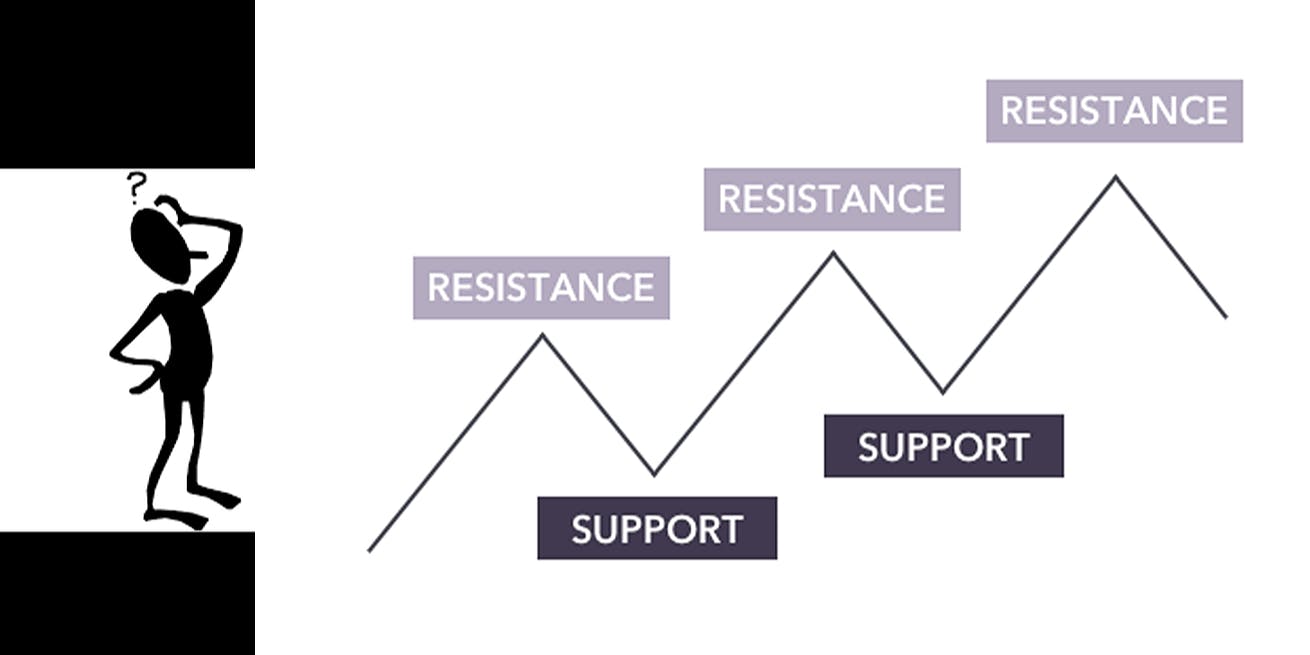

Reimagining Support and Resistance Indicators with Blockchain Datasets

by

September 10th, 2019

Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa

About Author

Chief Scientist, Managing Partner at Invector Labs. CTO at IntoTheBlock. Angel Investor, Writer, Boa