502 reads

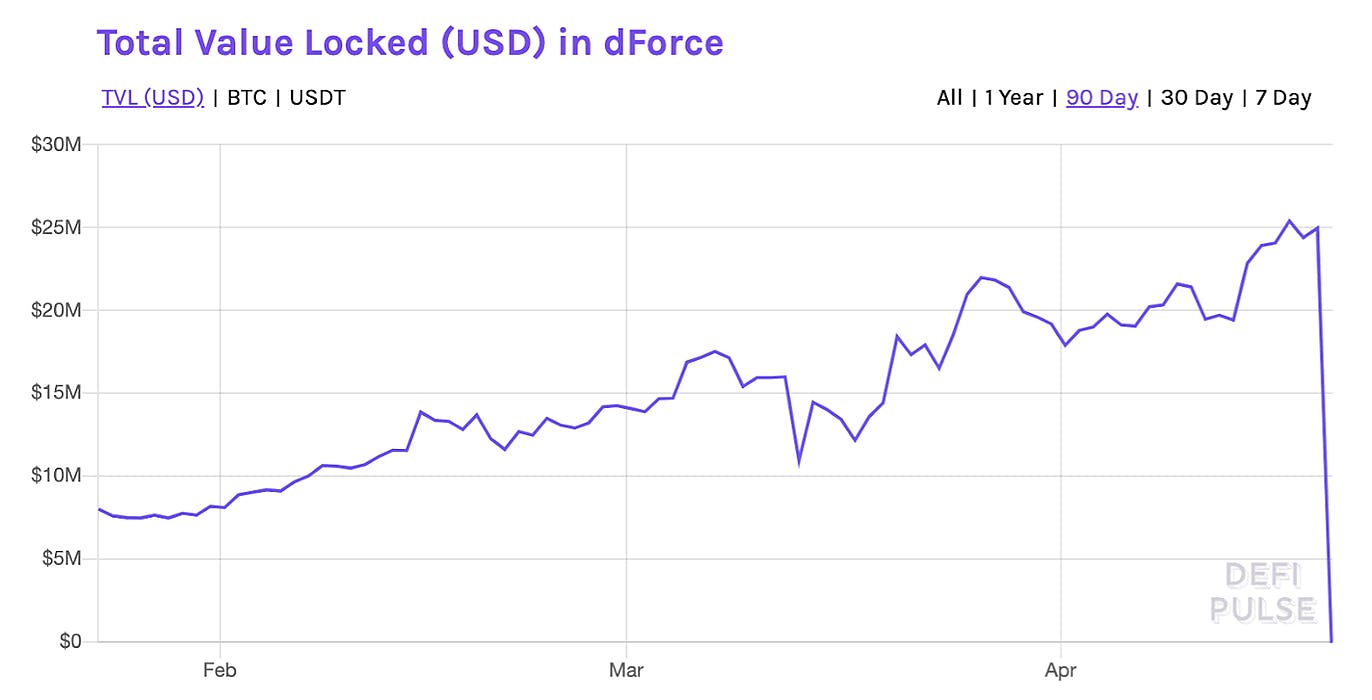

Is DeFi Now Dead? Inside the dForce / LendfMe 25 Million USD Hack!

by

April 20th, 2020

Co-Founder CakeDeFi & I-Unlimited, Bestselling Author, Keynote Speaker, Medical Doctor, Athlete

About Author

Co-Founder CakeDeFi & I-Unlimited, Bestselling Author, Keynote Speaker, Medical Doctor, Athlete