518 reads

How AI and Machine Learning are Reshaping SaaS FinTech

by

February 24th, 2023

Audio Presented by

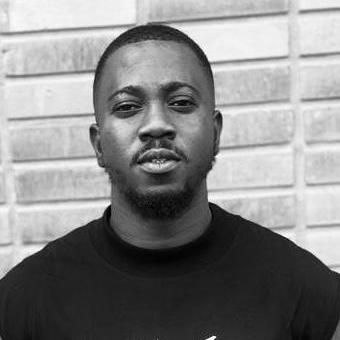

B2B SaaS, Tech, Crypto & AI writer. Passion for simplifying complex ideas & present them in a clear manner.

About Author

B2B SaaS, Tech, Crypto & AI writer. Passion for simplifying complex ideas & present them in a clear manner.