639 reads

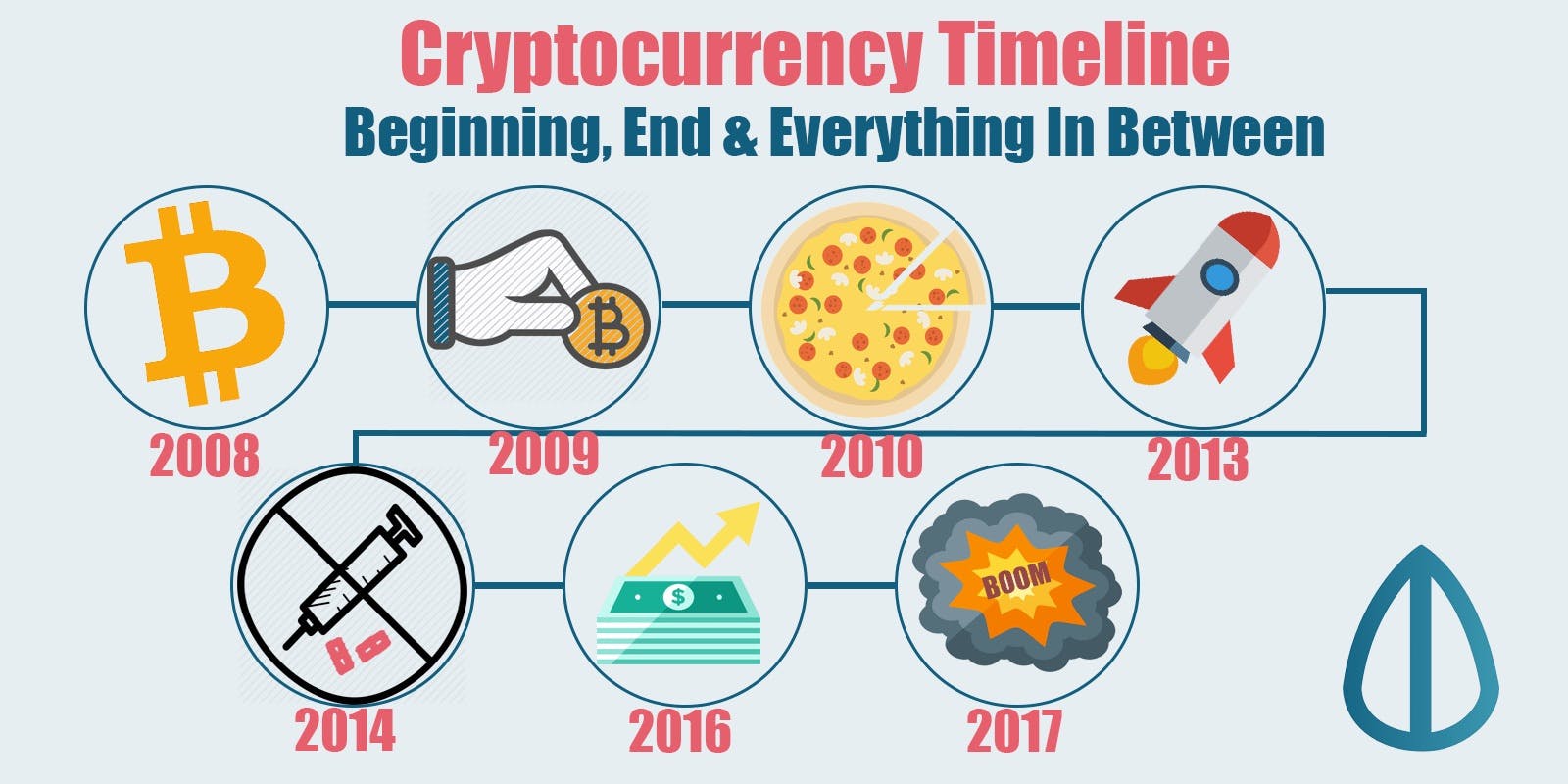

History & Evolution of Fiat Money To Digital Assets

by

March 6th, 2022

Audio Presented by

A smiling survivor serving in ethical tech Termed "Stablecoin Queen" & “the heart of social impact blockchain.”

About Author

A smiling survivor serving in ethical tech Termed "Stablecoin Queen" & “the heart of social impact blockchain.”