417 reads

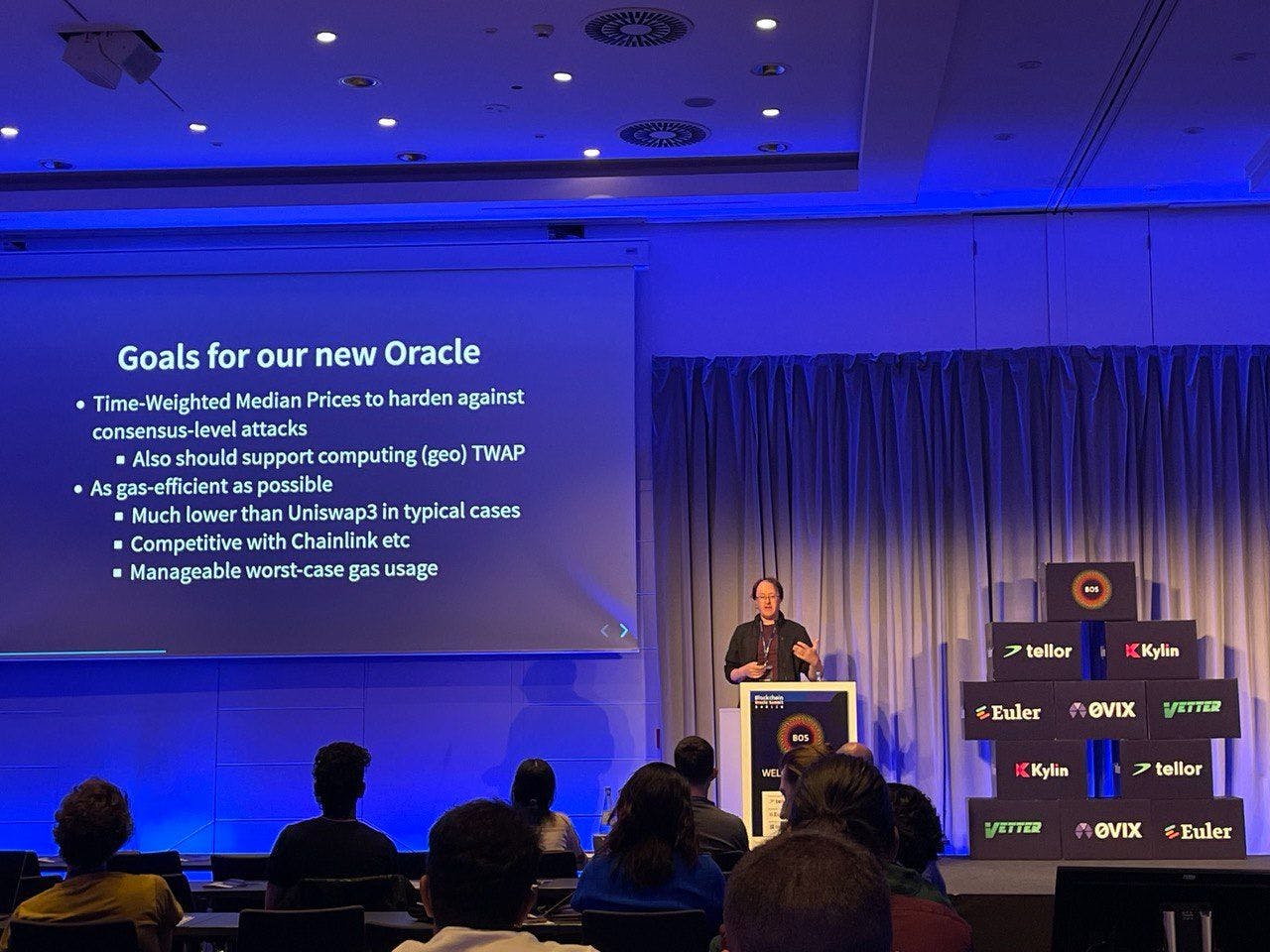

Euler Introduces New Design to Evaluate On-Chain Median Pricing Oracles

by

November 4th, 2022

Audio Presented by

The Blockchain Oracle Summit is the only event in the world to focus solely oracles.

Story's Credibility

About Author

The Blockchain Oracle Summit is the only event in the world to focus solely oracles.