511 reads

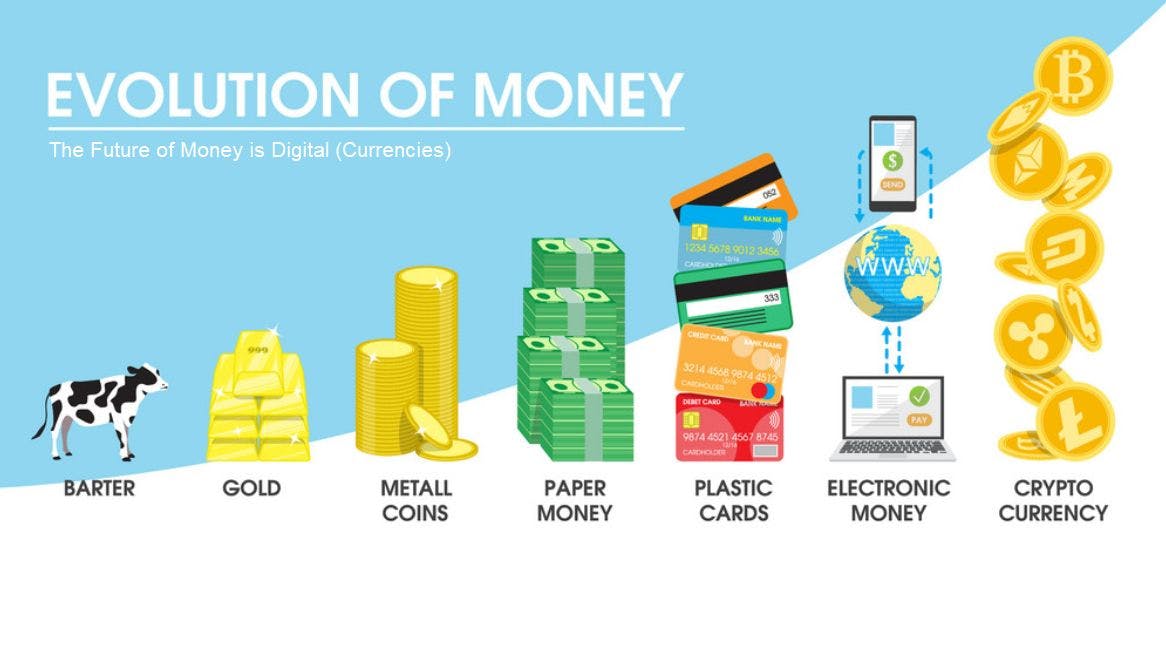

Barter to Bitcoin: The Evolution of Money Through The Ages

by

January 9th, 2021

Founder of DigitalGen Financial Services. Focusing on financial and crypto education.

About Author

Founder of DigitalGen Financial Services. Focusing on financial and crypto education.