437 reads

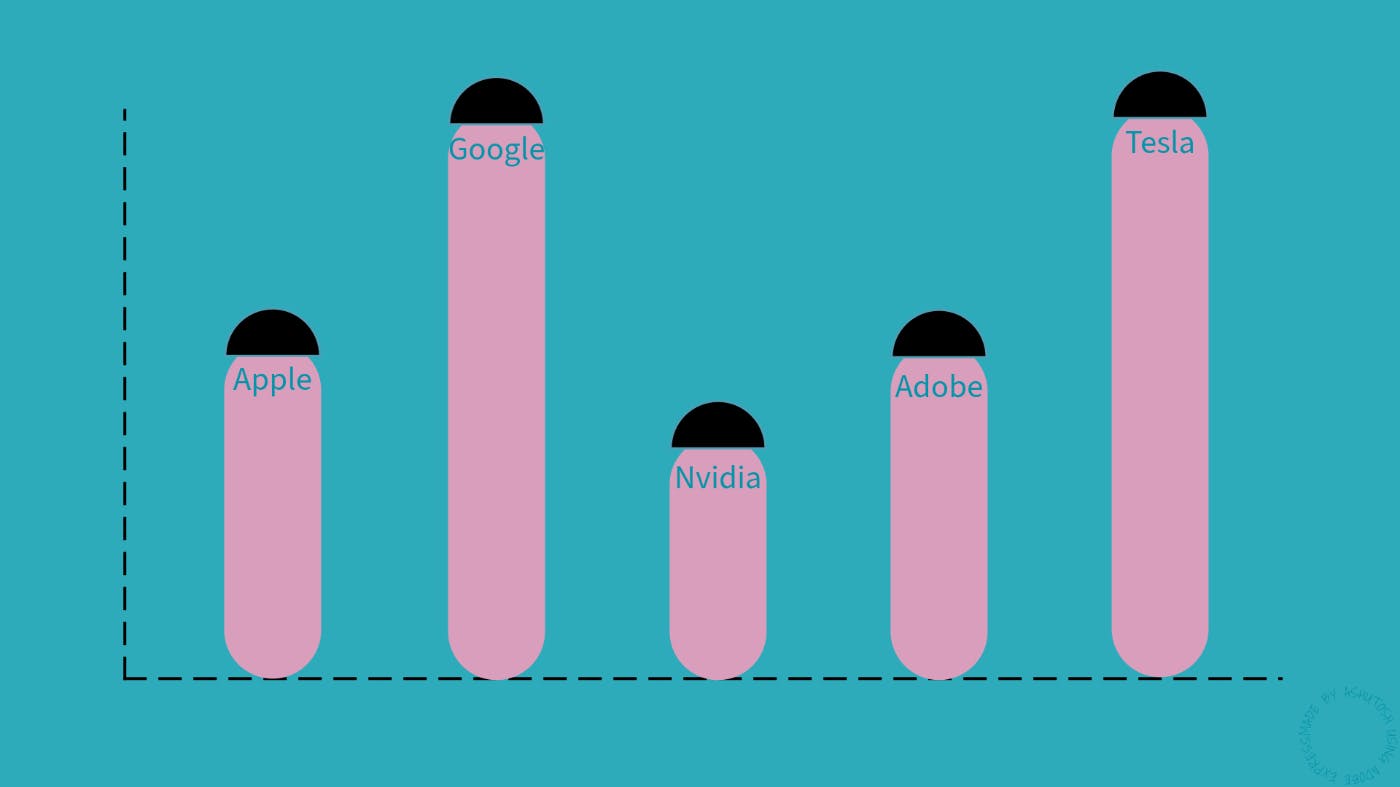

How To Achieve Target Allocation Ratio (TAR) in Your Investment Portfolio

by

February 19th, 2024

Audio Presented by

Senior Software Engineer with 4+ years of experience architecting performant microservices and optimizing critical systems.

Story's Credibility

About Author

Senior Software Engineer with 4+ years of experience architecting performant microservices and optimizing critical systems.