360 reads

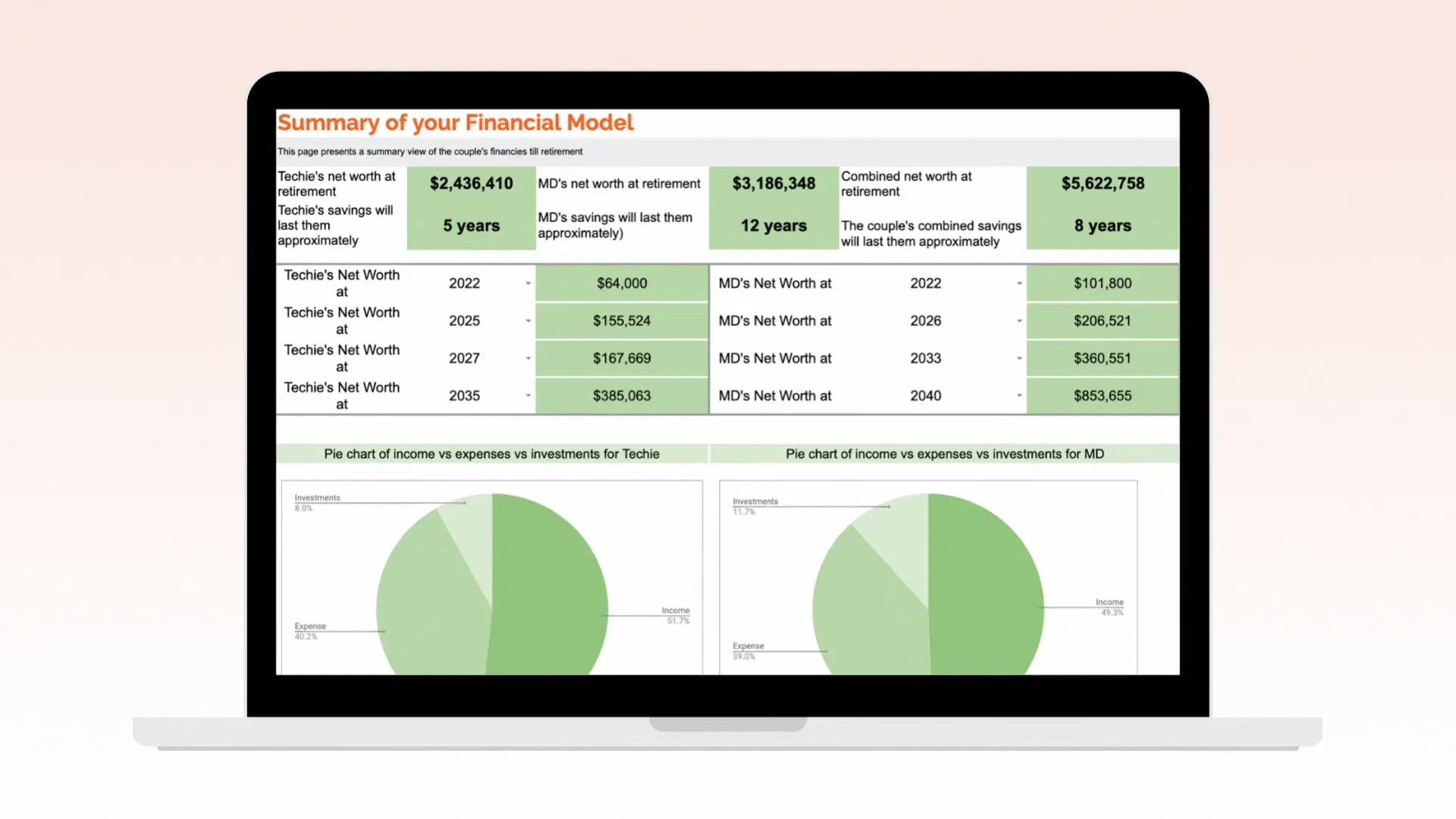

Using Google Sheets to Forecast Our Financial Future Together

by

November 28th, 2022

Audio Presented by

We build fun digital products and experiences that helps couples communicate and build a deeper connection.

Story's Credibility

About Author

We build fun digital products and experiences that helps couples communicate and build a deeper connection.