485 reads

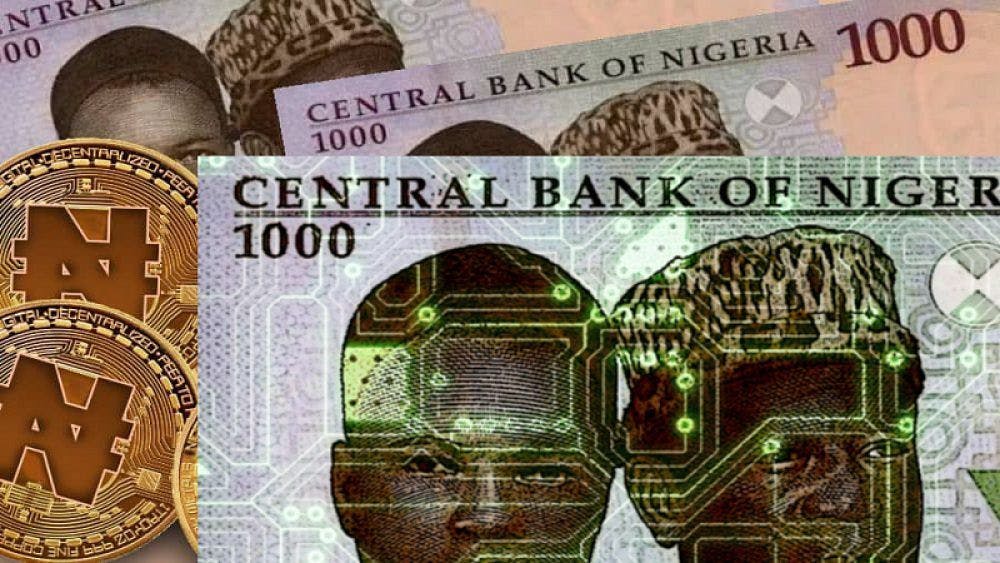

Why Nigeria’s “Speed Wallet” Concept is Crucial for CBDC Implementation Projects

by

September 16th, 2021

Audio Presented by

Hugh writes about cyberspace, digital currencies, economics, foreign affairs, and emerging technologies.

About Author

Hugh writes about cyberspace, digital currencies, economics, foreign affairs, and emerging technologies.