3,362 reads

The Macroeconomics of Venture Capital

Too Long; Didn't Read

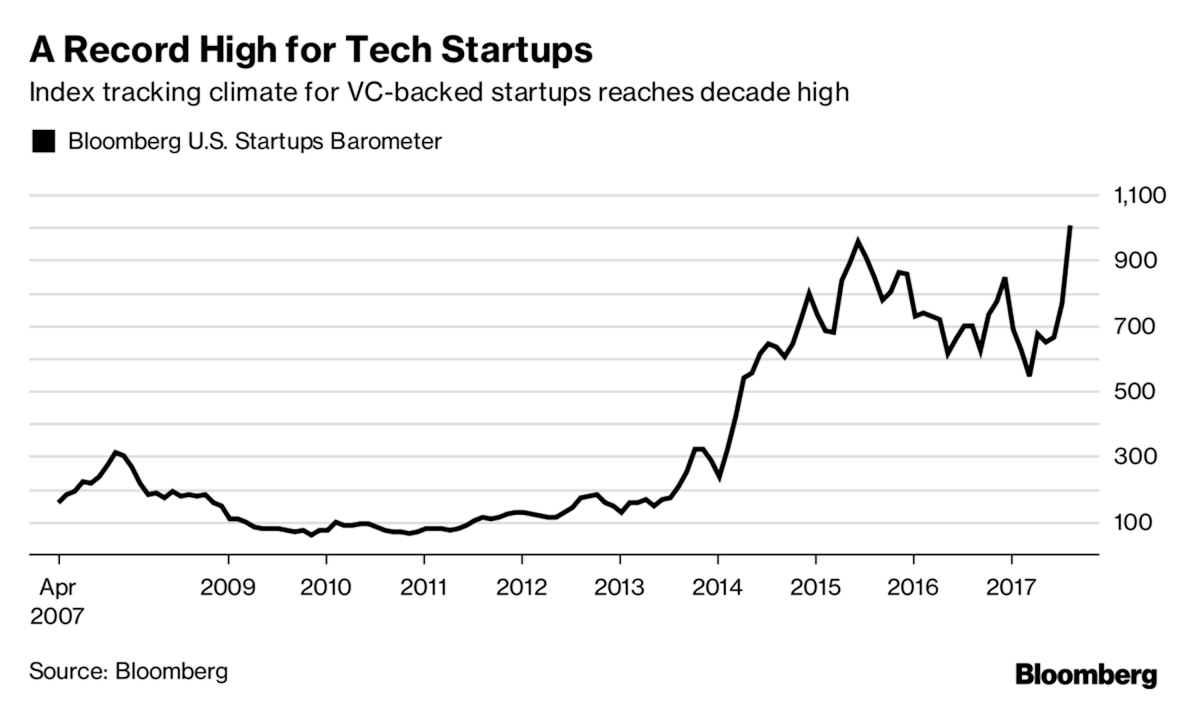

It’s become somewhat passé in recent years to say that technology valuations are frothy. It’s still up for debate whether or not there is a “tech bubble,” but few would disagree that investor expectations for startups remain high. What is less widely understood is how this situation came about, the historical underpinnings of where we are in the venture financing cycle, and what may come next. Below I propose a macroeconomic explanation.L O A D I N G

. . . comments & more!

. . . comments & more!