558 reads

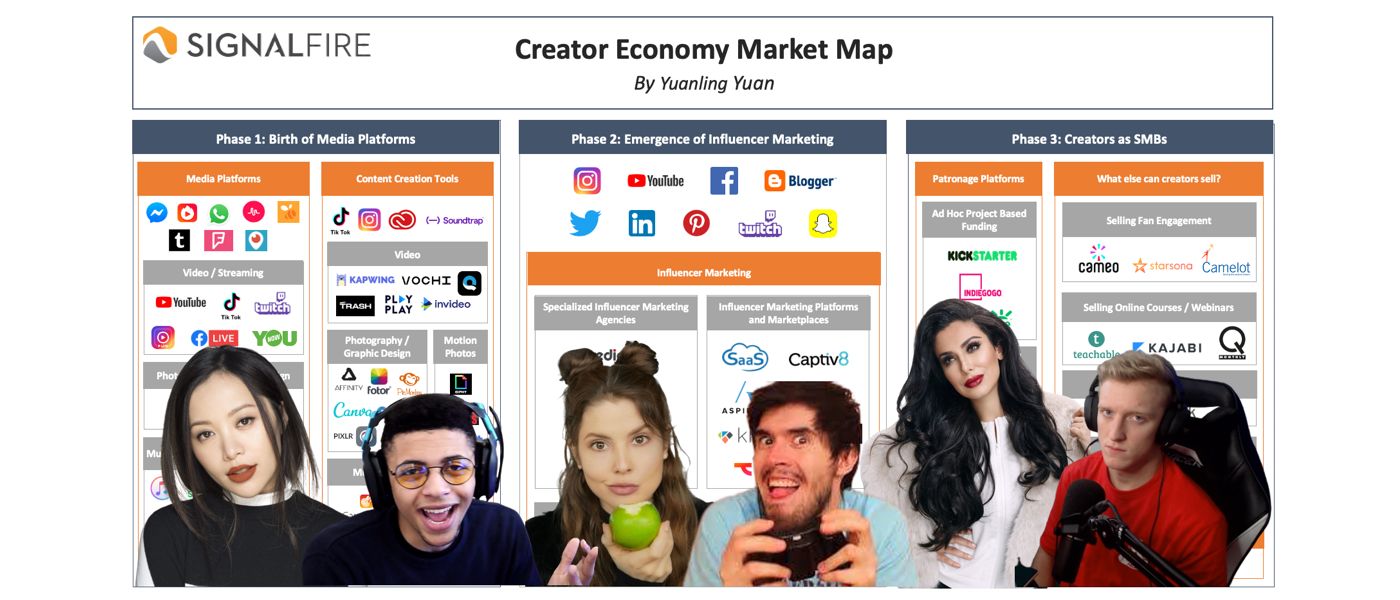

State of The Creator Economy: SignalFire’s Market Map and Analysis

by

September 28th, 2020

I'm a principal investor at early stage VC fund SignalFire. Previously I was TechCrunch's editor-at-Large for 8 years.

About Author

I'm a principal investor at early stage VC fund SignalFire. Previously I was TechCrunch's editor-at-Large for 8 years.