126 reads

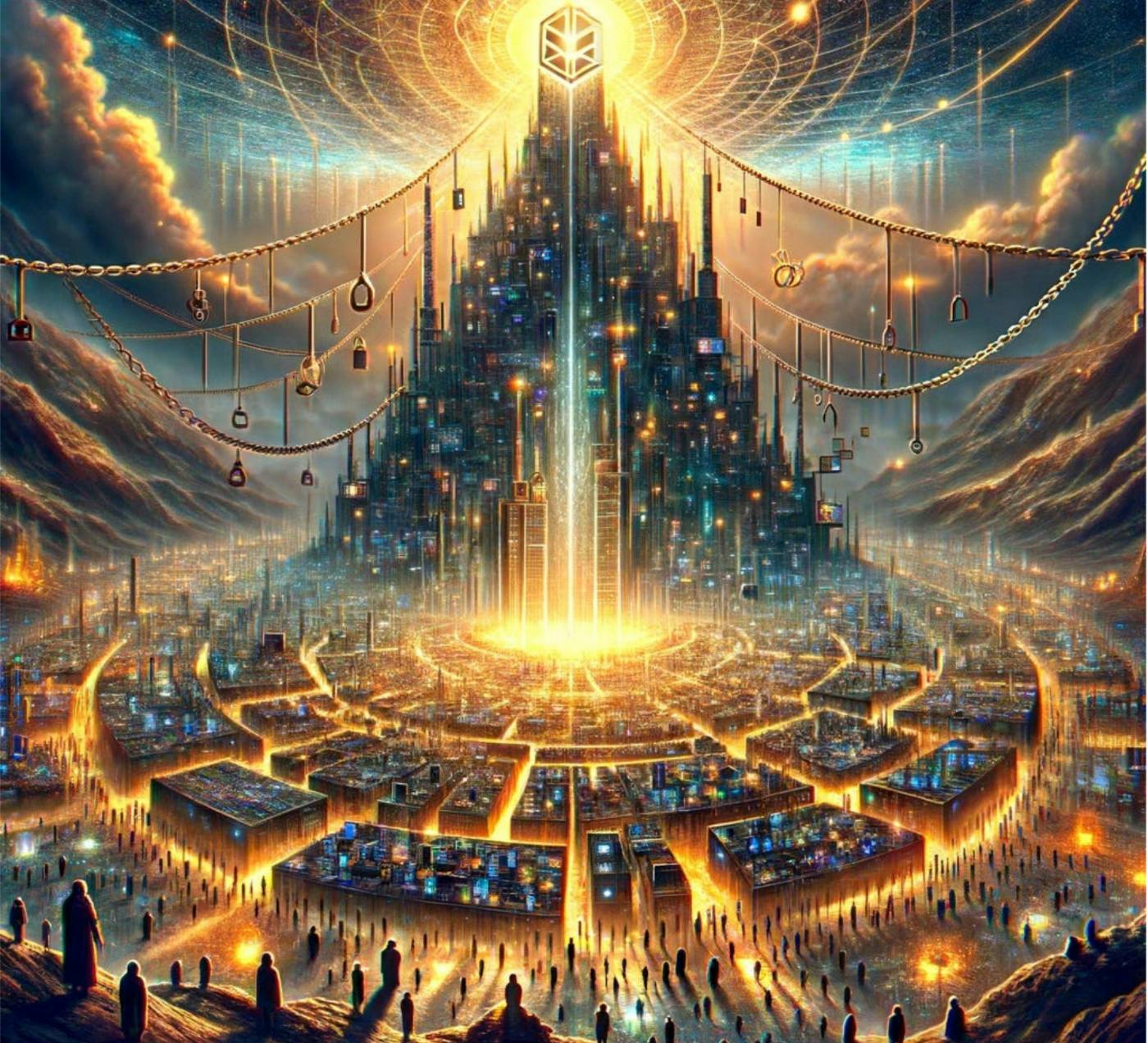

Rethinking Cryptoeconomics – Part 5: Navigating Innovation and Inequality in Blockchain Economics

by

February 6th, 2024

Audio Presented by

delegat0x is a crypto R&D Engineer, libertarian anti-capitalist, decentralization and direct democracy maxi.

About Author

delegat0x is a crypto R&D Engineer, libertarian anti-capitalist, decentralization and direct democracy maxi.