4,541 reads

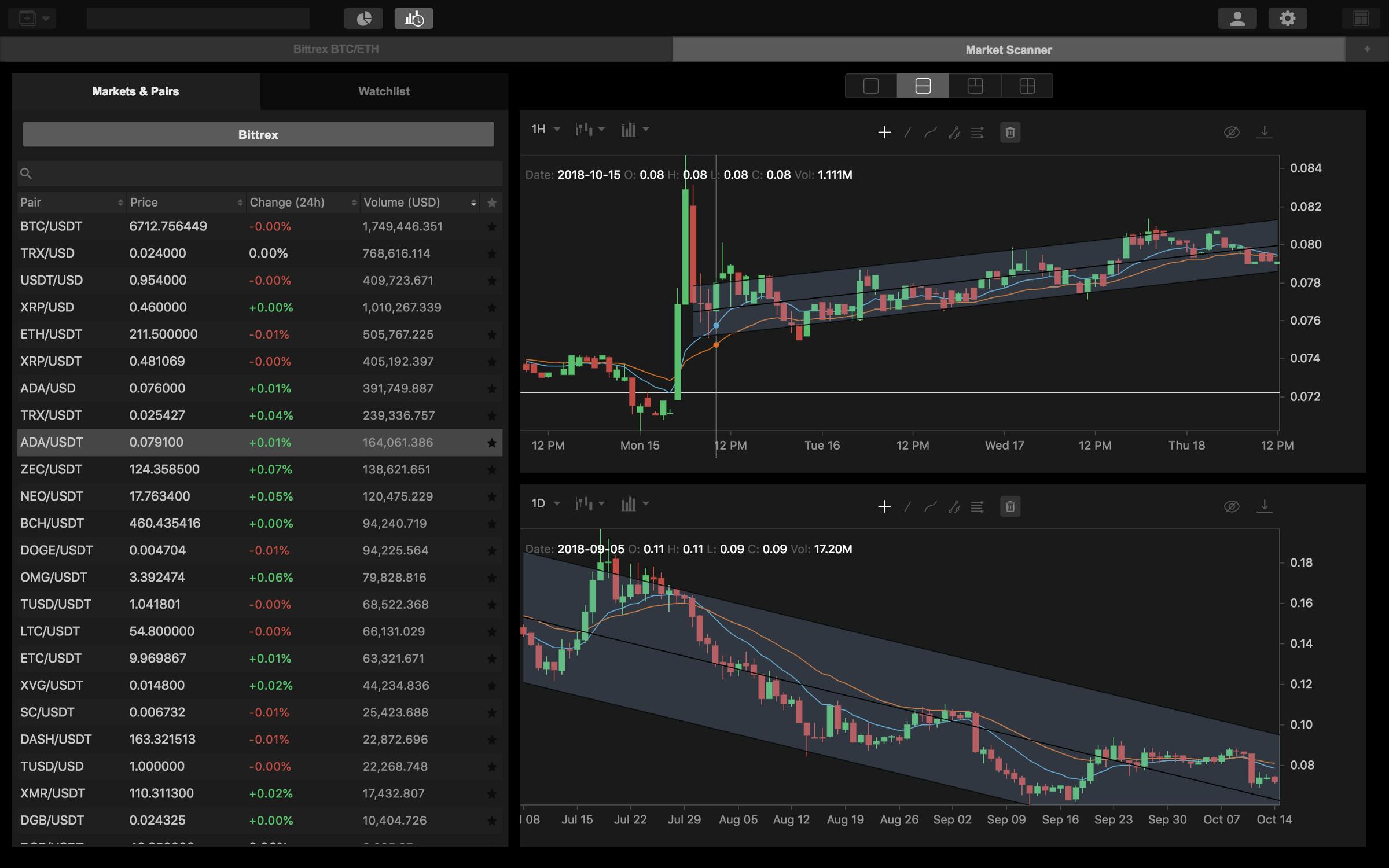

Hack your Crypto-Trading with Multiple Time Frame Analysis

by

October 17th, 2018

Audio Presented by

Kattana is a cross-chain trading terminal for DEXs and CEXs. Ethereum, BSC, Polygon, HECO, Avalanche, and Elrond

About Author

Kattana is a cross-chain trading terminal for DEXs and CEXs. Ethereum, BSC, Polygon, HECO, Avalanche, and Elrond

Comments

TOPICS

Related Stories

1inch is ...Inflationary?

May 24, 2021