543 reads

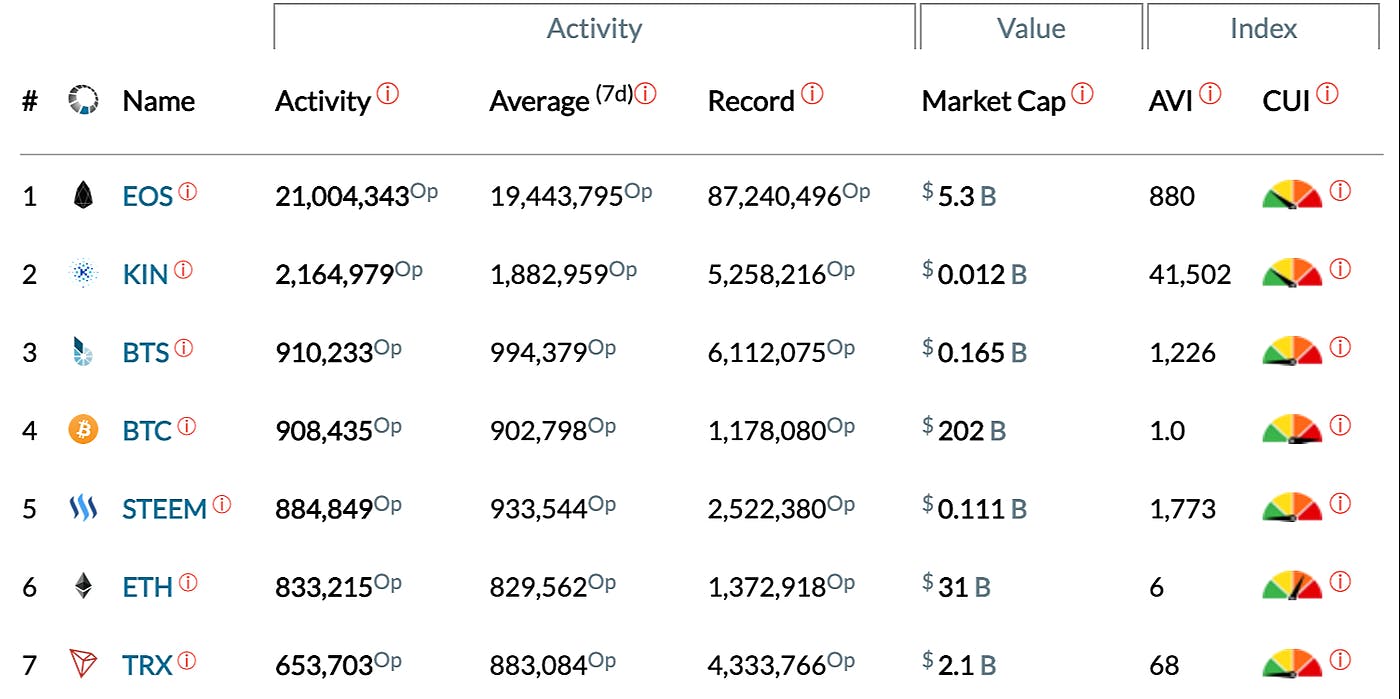

Is EOS Overtaking Ethereum? A Deep Dive into Network Activities

by

August 31st, 2019

Technology entrepreneur with a management consulting background. Into blockchain, especially decentralized finance. MBA.

About Author

Technology entrepreneur with a management consulting background. Into blockchain, especially decentralized finance. MBA.