486 reads

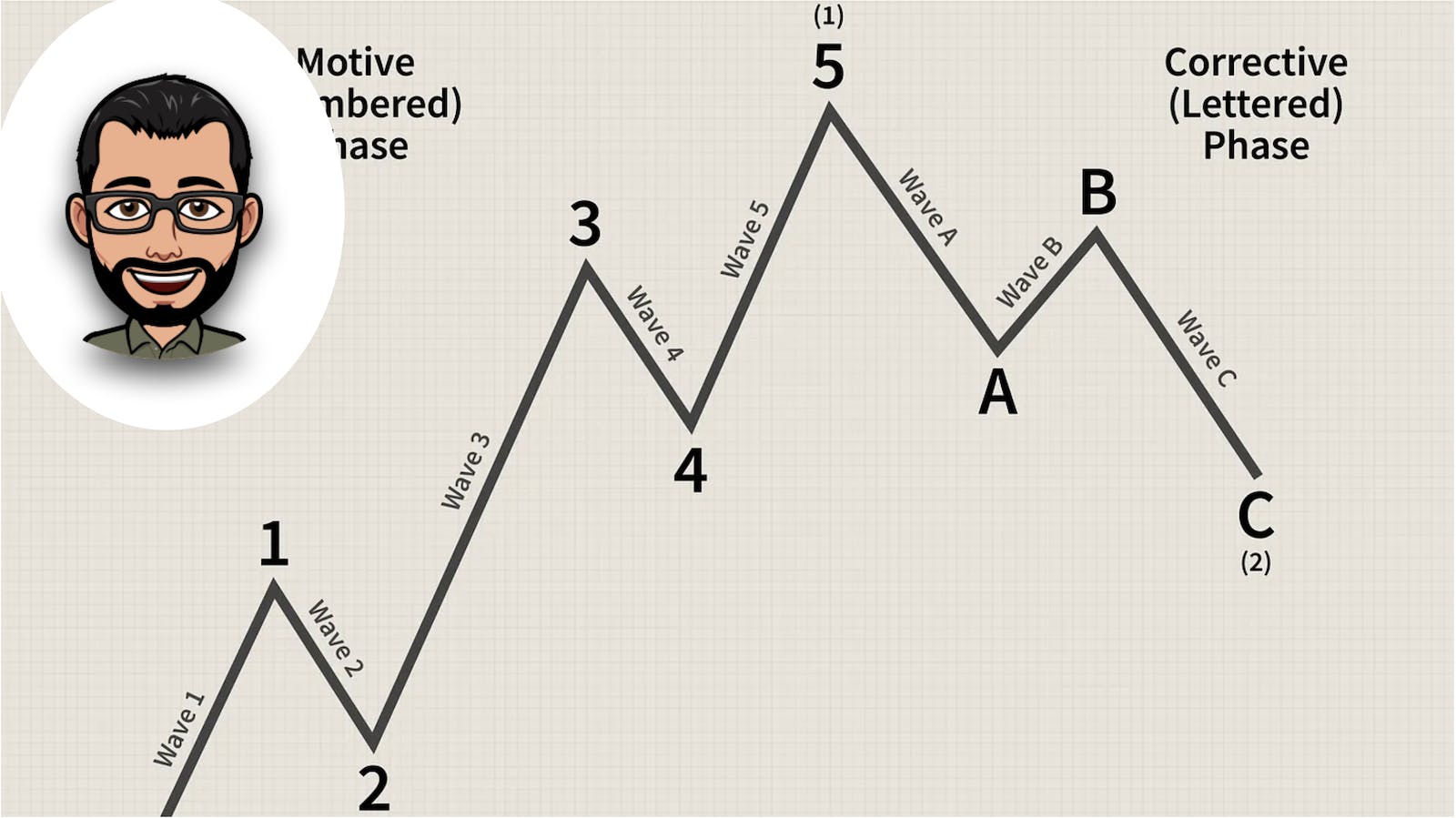

Crypto Supercycle 2025? Elliott Waves Tell the True Story

by

January 20th, 2025

Audio Presented by

Editor, Crypto is Easy newsletter. #1 writer, Medium. Bitcoin author, analyst, commentator.

Story's Credibility

About Author

Editor, Crypto is Easy newsletter. #1 writer, Medium. Bitcoin author, analyst, commentator.

Comments

TOPICS

Related Stories

1inch is ...Inflationary?

May 24, 2021