627 reads

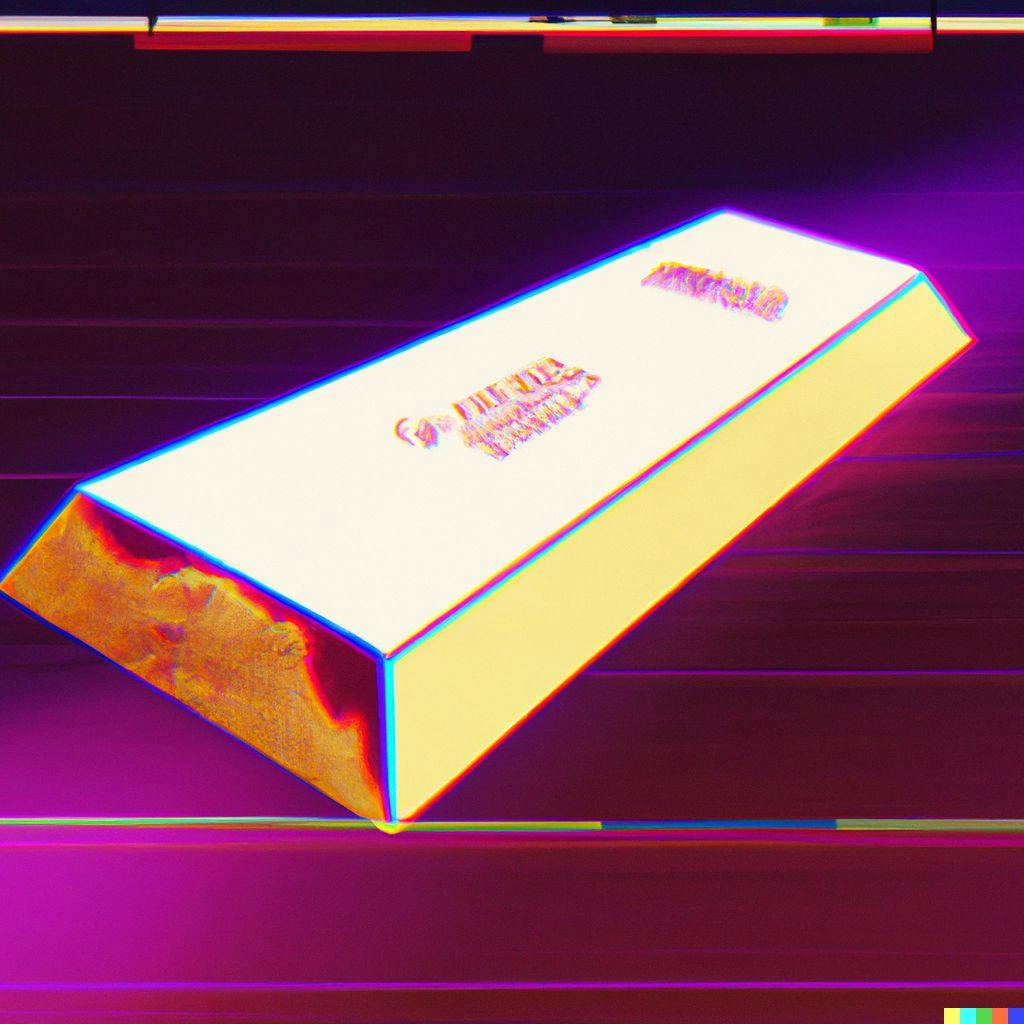

Coinflip Introduces PAX Gold (PAXG) to Its Network of 4,000 ATMs

by

March 30th, 2023

Audio Presented by

Story's Credibility

About Author

Founder of DecentReviews.co and GrowthModels.co

Comments

TOPICS

THIS ARTICLE WAS FEATURED IN

Related Stories

Why Use a Bitcoin ATM?

Mar 11, 2022