1,610 reads

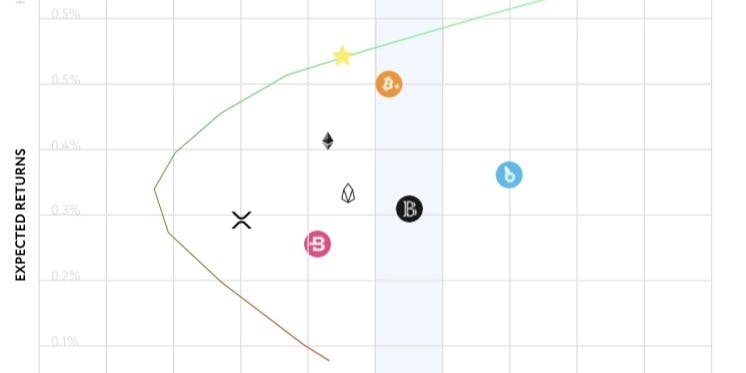

How We Can Apply Modern Portfolio Theory to the Сryptocurrency Markets

by

July 16th, 2019

Audio Presented by

Holderlab.io is a free service for automated crypto portfolio management with automatic rebalancing

About Author

Holderlab.io is a free service for automated crypto portfolio management with automatic rebalancing