743 reads

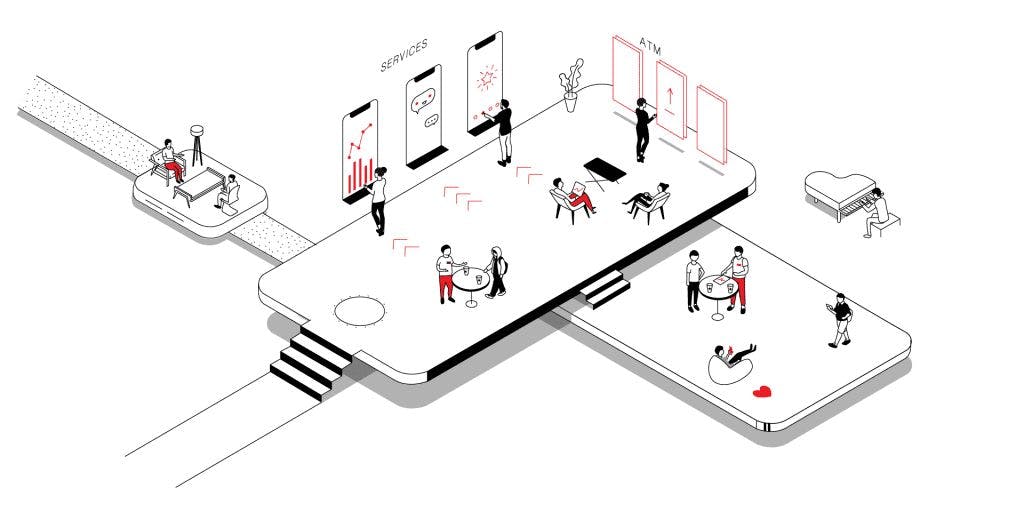

Brick-And-Mortar Banks are Losing the Battle to their Digital Counterparts

by

November 28th, 2021

Audio Presented by

Fintech journalist. My works are featured by Cointelegraph, Investing, SeekingAlpha.

About Author

Fintech journalist. My works are featured by Cointelegraph, Investing, SeekingAlpha.