751 reads

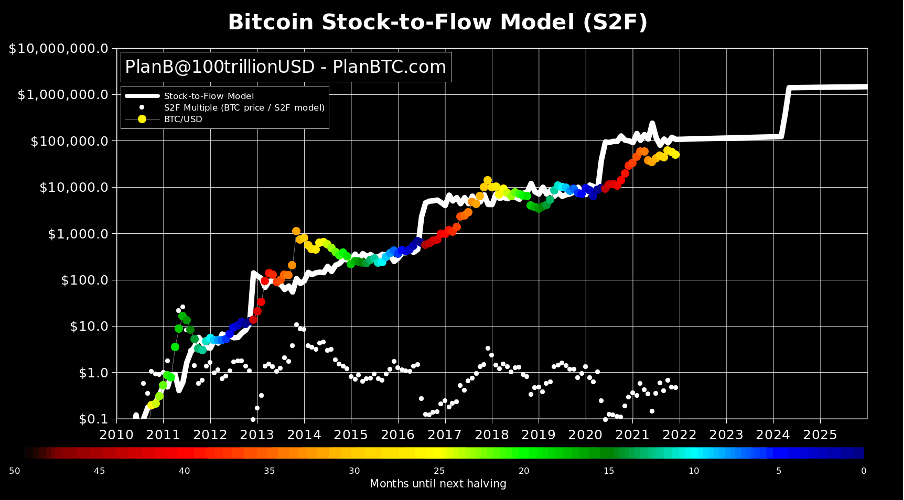

Breaking down Bitcoin’s Stock-to-Flow Cross-Asset Model

by

June 6th, 2022

Audio Presented by

CEO and co-founder of Platinum Software Development Company. Blockchain enthusiast, blogger.

About Author

CEO and co-founder of Platinum Software Development Company. Blockchain enthusiast, blogger.