401 reads

An Introduction to Relative Strength Index Trading Strategies

Too Long; Didn't Read

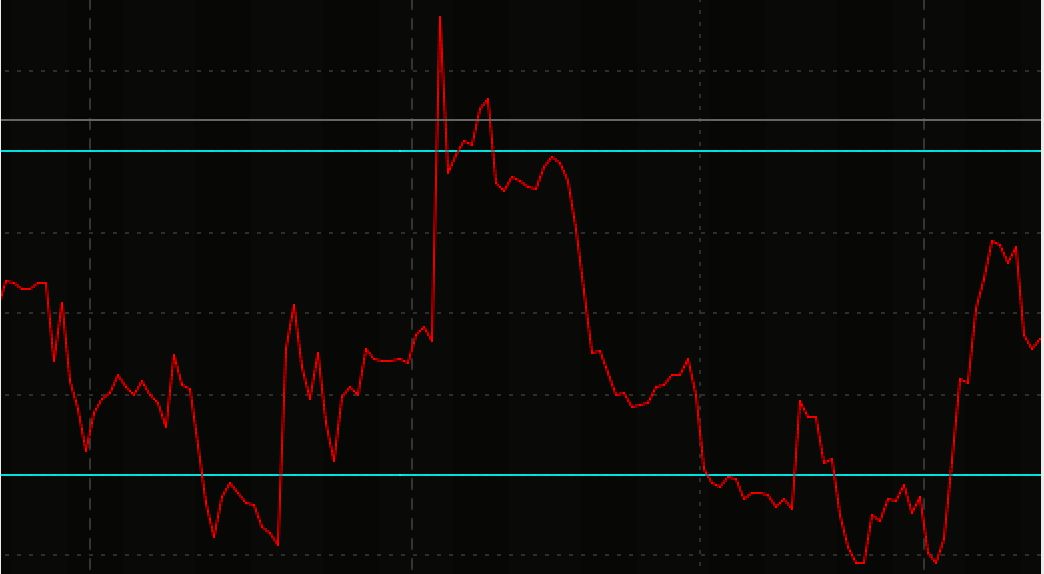

Relative Strength Index (RSI) is a momentum indicator. It measures the speed and change of price movements to evaluate if a stock is overbought or oversold. The traditional interpretation of the RSI sees the areas below 30% and above 70% as significant territories. RSI can also be used to reveal price trends and suggest points to enter and exit trades. Using RSI is pointless if you don’t understand how the value is computed and what it actually tells you.Writing about law, Wall Street, VC & startups.

L O A D I N G

. . . comments & more!

. . . comments & more!